Frequently Asked Questions

My assessed value went up more than 2%. Doesn't Prop 13 keep it from increasing more than 2% a year?

How property values are assessed

What is Proposition 13?

Proposition 13, passed in 1978, established the base year value concept for property tax assessments. Under Proposition 13, the 1975-1976 fiscal year serves as the original base year used in determining the assessment for real property. Thereafter, annual increases to the base year value are limited to the inflation rate, as measured by the California Consumer Price Index, or two percent, whichever is less. A new base year value, however, is established whenever a property, or portion thereof, has had a change in ownership or has been newly constructed. Under Proposition 13, the property tax rate is fixed at one percent of assessed value plus amounts required to repay any assessment bonds approved by the voters.

Reference: Section 2 of Article XIII A of the California Constitution.

What is Proposition 8?

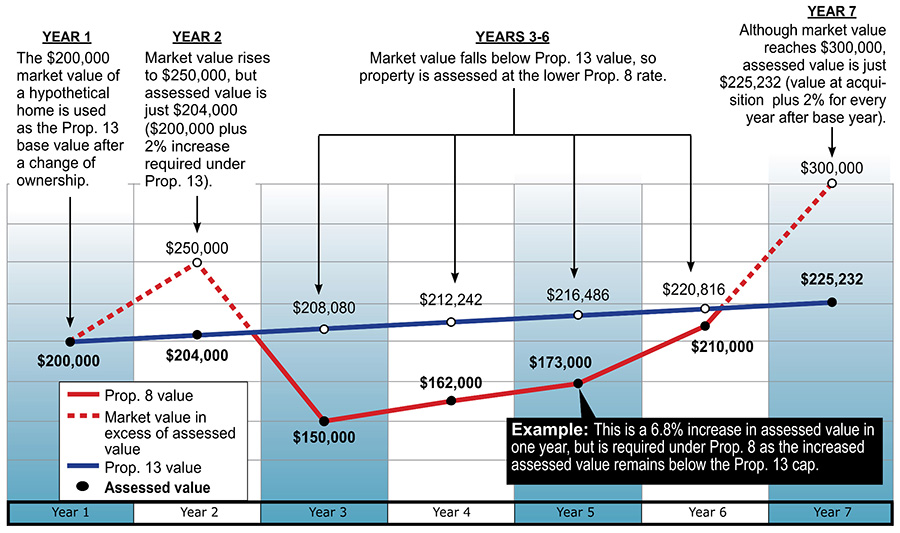

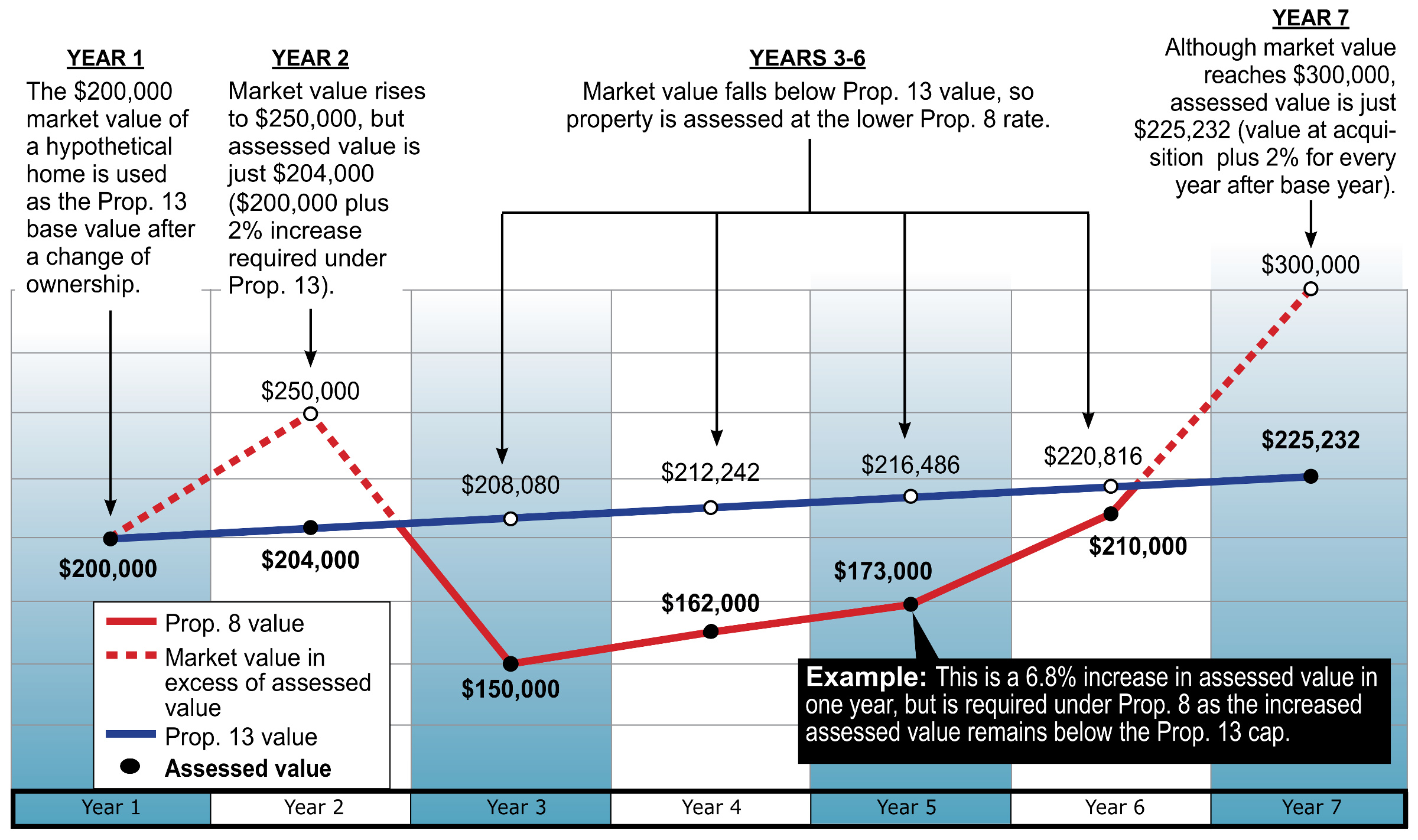

Proposition 8 requires the county assessor to annually enroll either a property’s adjusted base year value (Proposition 13 value) or

its current market value, whichever is less. When the current market value replaces the higher Proposition 13 value on the assessor’s

roll, that lower value is commonly referred to as a "Prop 8" value.

Although the annual increase for a Prop 13 value is limited to no more than two percent, the same restriction does not apply to values adjusted under Prop 8. The market value of a Prop 8 property is reviewed annually as of January 1; the current market value must be enrolled as long as the Prop 8 value still falls below the Prop 13 value. Thus, any subsequent increase or decrease in market value is enrolled regardless of any percentage increase or decrease. When the current market value of a Prop 8 property exceeds its Prop 13 value (adjusted for inflation), the county assessor reinstates the Prop 13 value.

Reference: Section 2(b) of Article XIII A of the California Constitution and section 51 of the Revenue and Taxation Code.

How property values are assessed

What is Proposition 13?

Proposition 13, passed in 1978, established the base year value concept for property tax assessments. Under Proposition 13, the 1975-1976 fiscal year serves as the original base year used in determining the assessment for real property. Thereafter, annual increases to the base year value are limited to the inflation rate, as measured by the California Consumer Price Index, or two percent, whichever is less. A new base year value, however, is established whenever a property, or portion thereof, has had a change in ownership or has been newly constructed. Under Proposition 13, the property tax rate is fixed at one percent of assessed value plus amounts required to repay any assessment bonds approved by the voters.

Reference: Section 2 of Article XIII A of the California Constitution.

What is Proposition 8?

Proposition 8 requires the county assessor to annually enroll either a property’s adjusted base year value (Proposition 13 value) or

its current market value, whichever is less. When the current market value replaces the higher Proposition 13 value on the assessor’s

roll, that lower value is commonly referred to as a "Prop 8" value.

Although the annual increase for a Prop 13 value is limited to no more than two percent, the same restriction does not apply to values adjusted under Prop 8. The market value of a Prop 8 property is reviewed annually as of January 1; the current market value must be enrolled as long as the Prop 8 value still falls below the Prop 13 value. Thus, any subsequent increase or decrease in market value is enrolled regardless of any percentage increase or decrease. When the current market value of a Prop 8 property exceeds its Prop 13 value (adjusted for inflation), the county assessor reinstates the Prop 13 value.

Reference: Section 2(b) of Article XIII A of the California Constitution and section 51 of the Revenue and Taxation Code.

Disaster Relief

Disaster Relief

Refunds are processed by the Auditor and normally done within thirty (30) days of the date when the Assessor’s certifies the reduction. If you are due a refund and would like to check on the status of a refund, contact the Property Taxes & Assessment Division of the Auditor-Controller’s Office at (209) 525-6597.

Click for a larger image

Click for a larger image